Singularit

&nb...

Read Morelimit for new users

In The Philippines

LPeso is an SEC-licensed online cash loan application that provides unsecured, unsecured and secure loans to every Filipino borrower.

Low interest rate and fast personal loan service in the Philippines

Home credit cash loans provide small support for household expenses

Good credit loans can easily cope with daily capital turnover

Consumer loans provide timely convenience for Filipinos to shop

Travel loans provide financial guarantee for Filipinos’ happy travels

Medical loans provide financial protection for Filipinos’ physical health

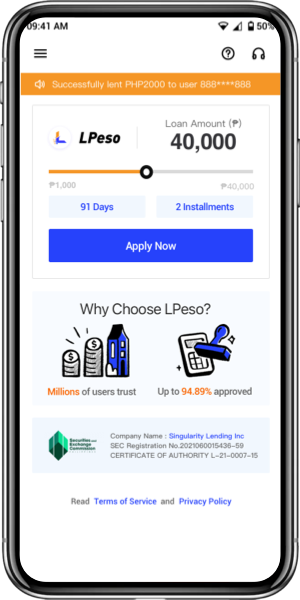

Company Name:Singularity Lending Inc.

SEC Registration No. 2021060015436-59

CERTIFICATE OF AUTHORITY NO. L-21-0007-15

LPeso provides a simple and secure loan application process, saving time and effort.

LPeso quickly transfers funds to the borrower’s account after loan approval.

LPeso’s clear and transparent interest rate and fee information, no hidden fees.

LPeso offers a variety of flexible repayment options to best suit your financial situation.

Borrowers can submit loan applications through the LPeso mobile app. When applying, you need to provide some necessary documents and information, such as proof of identity, contact information, etc.

The LPeso loan limit will be determined based on the borrower’s credit status and income status, and the maximum limit can reach ₱40,000.

LPeso loan interest rates will depend on different loan products and the borrower’s credit status. Borrowers can check specific interest rates when applying for a loan.

Applying for an LPeso loan requires meeting certain conditions, such as age, income, credit history, etc. Specific conditions can be viewed on the application page.

The approval time for LPeso loans will depend on the specific circumstances and is generally completed within 2 hours after the application is submitted.

LPeso may charge some handling fees. The calculation method and amount of these handling fees will be clearly listed in the loan agreement.

Borrowers can submit loan applications through the LPeso mobile app. When applying, you need to provide some necessary documents and information, such as proof of identity, contact information, etc.

Applying for an LPeso loan requires meeting certain conditions, such as age, income, credit history, etc. Specific conditions can be viewed on the application page.

The LPeso loan limit will be determined based on the borrower’s credit status and income status, and the maximum limit can reach ₱40,000.

The approval time for LPeso loans will depend on the specific circumstances and is generally completed within 2 hours after the application is submitted.